taxing unrealized gains 401k

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. An unrealized gain is an increase in your investments value that you have not captured by selling the investment.

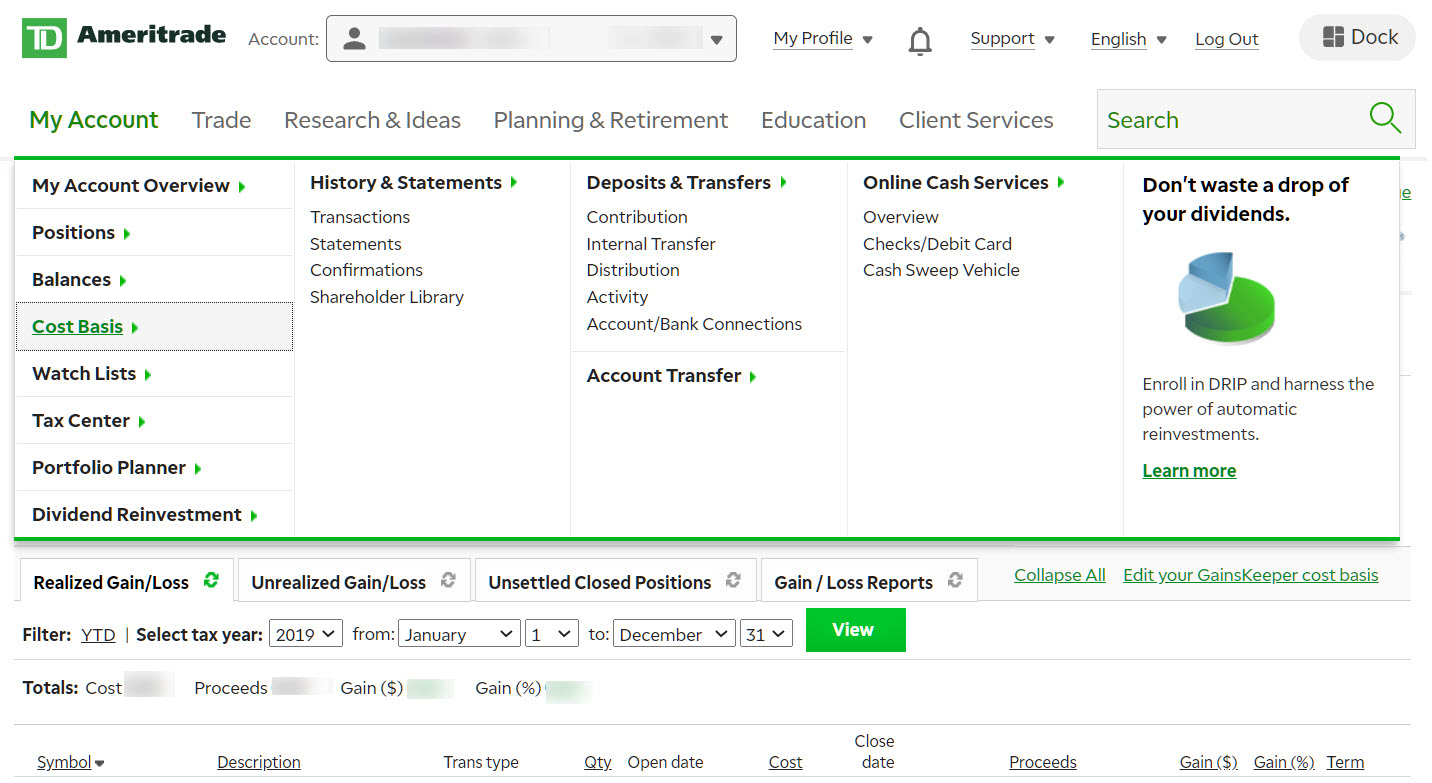

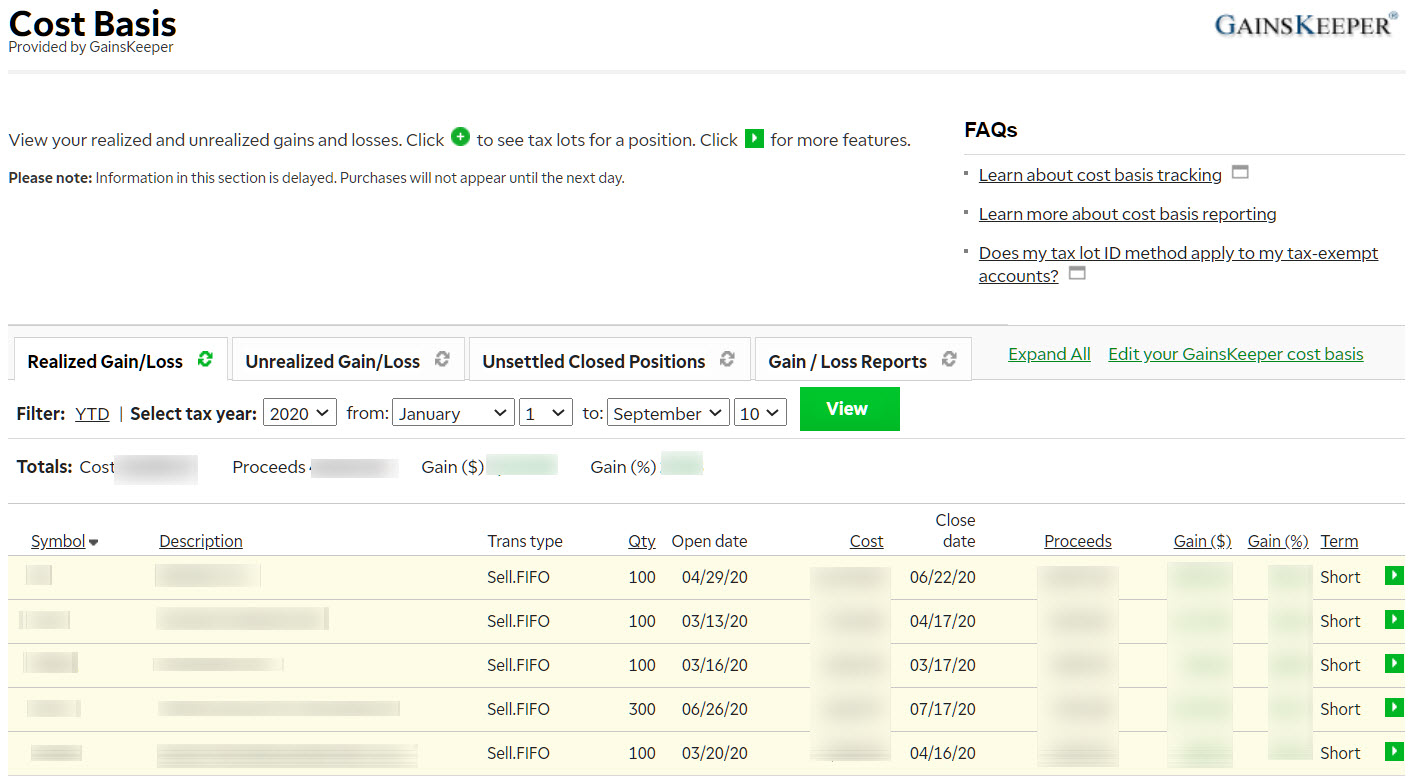

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

A tax on the stock of unrealized gains in 2022 could be expected to raise between 529 billion and 39 trillion depending on the tax rate chosen and the percentage of gains.

. So depending on where you live you may never have to pay state income taxes on your 401k money. You can turn unrealized capital losses into realized capital losses to offset realized capital gains and reduce your tax burden. The government would love to get 25 percent of your 401ks annual rise and our nations massive annual deficits and cumulative debt means it will need that money sooner.

Unrealized gains are not taxed until you sell the. The asset doesnt have to. The goal of investing is to earn a profit.

Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Taxes for Making an Early Withdrawal From a 401k The minimum age when you can.

To increase their effective tax rate. This means your heirs will never pay taxes on the unrealized gains. They only exist on paper.

Make Your Money Work For example say you bought a stock for 200 and it grew to 300 giving you a. Taxing unrealized gains is effectively the same as taxing someone for something they dont possess. The tax would be applied annually to unrealized gains which means that holders of stocks bonds or cryptocurrency could be taxed on increases before they have sold the assets.

If you decide to sell youd now have 14 in realized capital gains. To meet the minimum 20 tax requirement the household would have to pay an additional 12 million in taxes bringing the total to 3 million which is required for 15 million of total income. Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. In a simple scenario investors could end up paying the tax. 15 for single filers with taxable income between 40401 and 445850 41676 and 459750 in 2022 or between 80801 and 501600 for married couples filing jointly.

Taxing unrealized gains as they accruewhich Congressional Democrats have said is on the table for Americas billionairesor removing the tax code provision allowing.

How Does Taxing Unrealised Capital Gains Work Do You Force Them To Sell The Stock And Take Profit How Can You Tax Money That Has Not Materialised No Hate Just Curious

/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

Unrealized Gains And What They Mean For Your Taxes Advice Chaser

The Details Of Hillary Clinton S Capital Gains Tax Proposal Tax Foundation

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Own Company Stock Within Your 401 K That Could Mean A Tax Advantage Kiplinger

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

What You Need To Know About Capital Gains Tax

How Are 401 K Withdrawals Taxed

An Overview Of Capital Gains Taxes Tax Foundation

When Should 401 K Capital Gains Taxes Be Paid

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

What Are Unrealized Capital Gains Personal Capital

Biden Proposes New Minimum Tax On Billionaires Unrealized Gains Fox Business

An Inside Look At Biden S Proposed Unrealized Gains Tax Investment U

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)